- Zivoe Newsletter

- Posts

- Zivoe Surpasses $1M in Revenue as RWA Adoption Accelerates

Zivoe Surpasses $1M in Revenue as RWA Adoption Accelerates

Your Portal to Private Credit

🚀 Zivoe Surpasses $1M in Revenue

Zivoe has now reached $1.06M in cumulative revenue with $6.63M in TVL, delivering a gross return on assets of ~16% since launching last November. Despite softer crypto markets in recent weeks, interest in tokenized real-world assets has remained strong.

Private credit continues to be the fastest-growing segment within tokenization, and Zivoe enters the final month of the year with solid momentum.

📊 Tokenized Real-World Assets Hold Strong Amid Broader Volatility

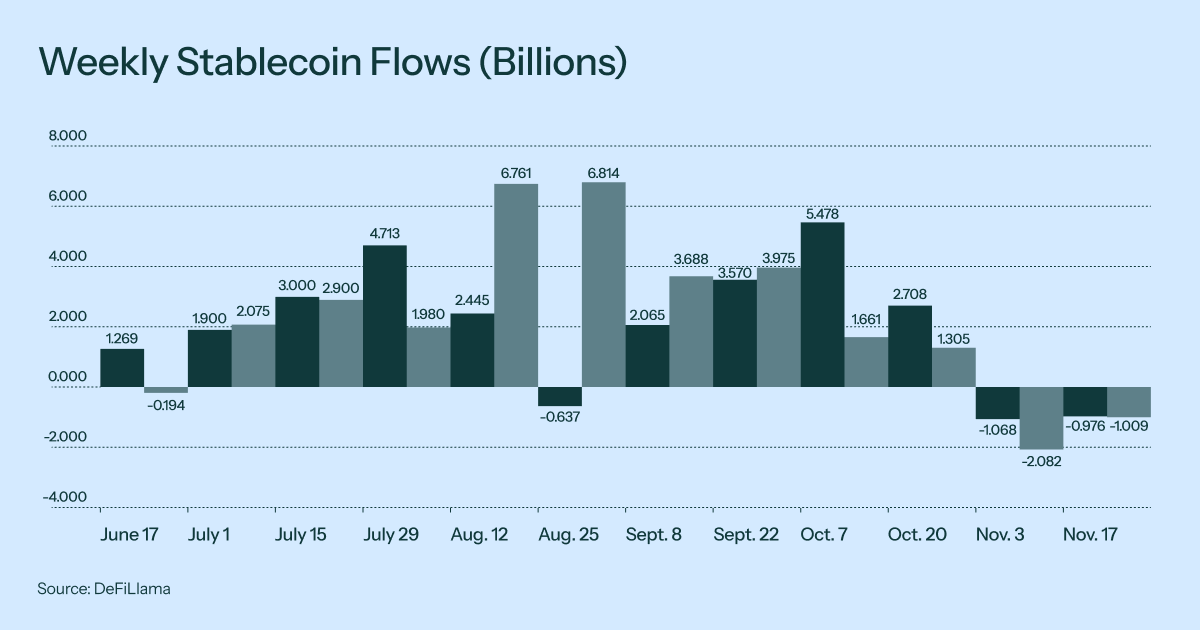

Crypto markets have pulled back in recent weeks with BTC and ETH falling below $85K and $2.75K respectively as of December 1st. This has coincided with tightening liquidity across the ecosystem, reflected in net outflows from stablecoins over the last 30 days.

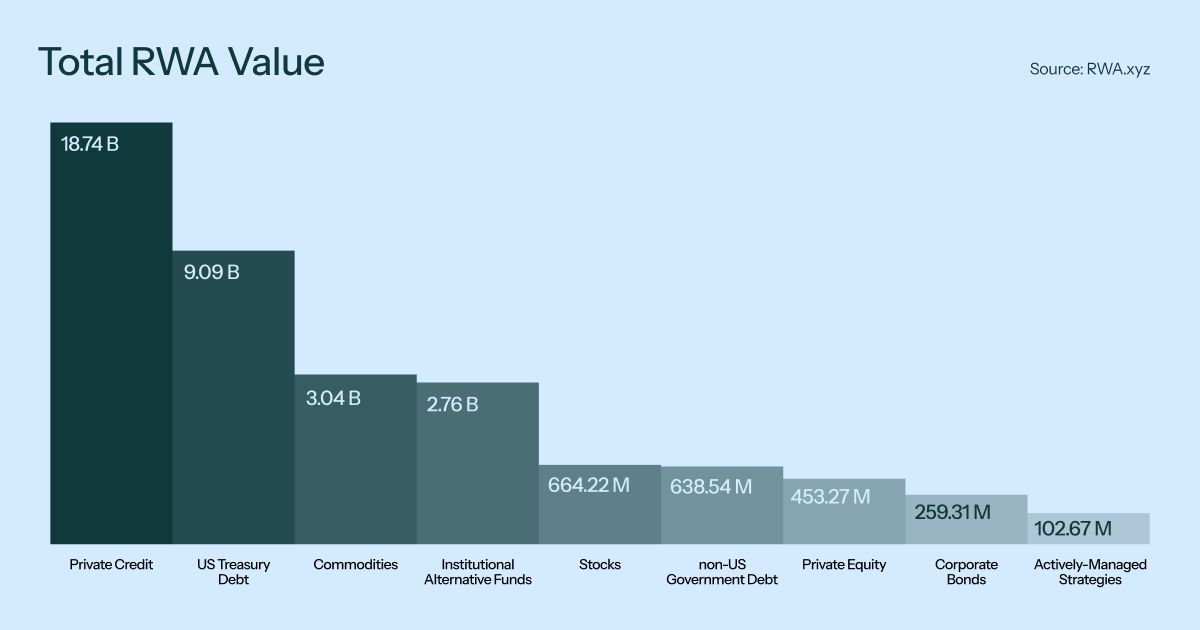

Despite this broader weakness, capital has been rotating into more conservative yield opportunities such as tokenized real-world assets and high-APR stables. Over the last thirty days, total tokenized private credit has grown by roughly $360M, reaching $18.74B — nearly double the next largest category according to RWA.xyz.

🌍 Institutions, Governments, and Emerging Markets Accelerate Tokenization

The resilience of tokenized real-world assets despite broader market weakness is being driven by several factors:

The space is waking up to the importance of consistent returns from real assets.

Institutions and governments are beginning to move decisively as the benefits of tokenization become clearer.

Demand for yield continues globally as more individuals hold dollars in the form of stablecoins and look to put those assets to work.

Institutional momentum is building quickly

In the last week alone, major players continued to expand their tokenization strategies:

Citi Advances Crypto Strategy with Custody Services and Tokenized Deposits[1]

Sony to Launch USD Stablecoin for PlayStation and Crunchyroll Payments by 2026[2]

Caesar Partners with Centrifuge to Pioneer First Crypto-Native Onchain Equity Issuance[3]

Amundi Launches First Tokenized Share Class on Ethereum[4]

Fidelity's Tokenized Treasury Fund Surpasses $250M on Ethereum[5]

Institutions are clearly here and positioning themselves early, but there remains enormous room for growth. Amundi alone manages approximately €2.3T in AUM, which is greater than the entire current TVL of crypto.

Governments are taking meaningful steps as well

Regulatory alignment is improving across several markets. Recent examples include:

Governments such as South Korea and Bolivia are clearly warming to tokenization and adapting their regulatory frameworks to support it. As this momentum builds, more people will gain access to crypto markets and projects will have greater clarity to expand their offerings.

The emerging market story

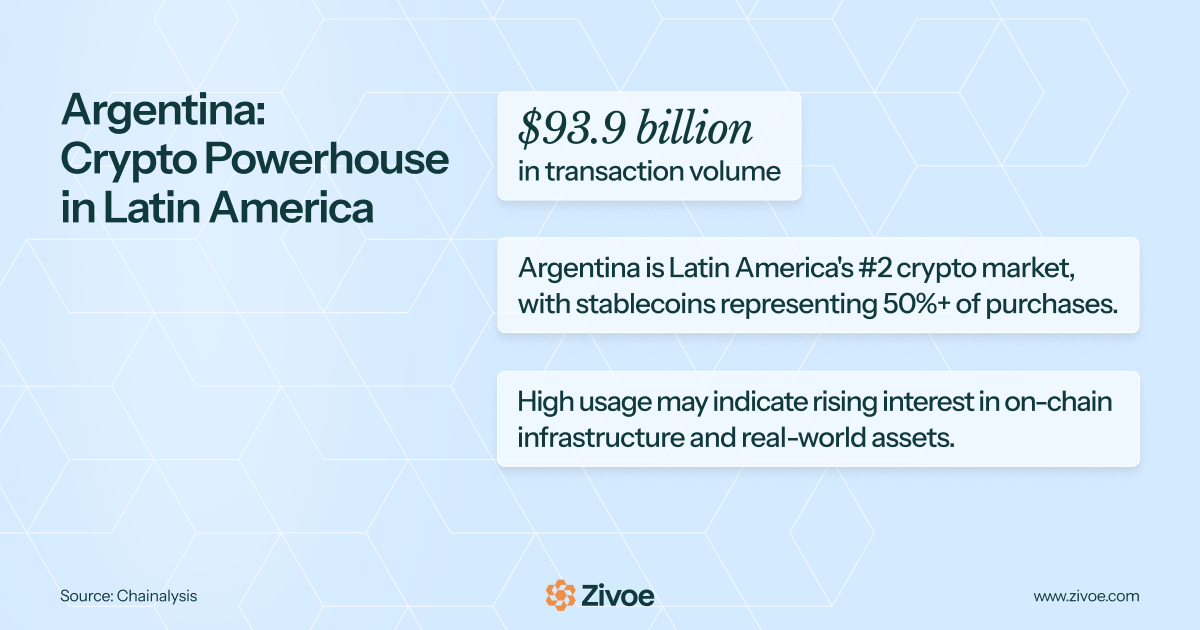

DevConnect Argentina, the largest Ethereum event of the year, drew more than 20,000 attendees. The turnout highlights the rising interest in emerging markets such as South America, where macroeconomic instability has accelerated demand for digital dollars. The IMF has noted that stablecoins are increasingly used as a “household-level hedge” against local currency devaluation.[9]

Momentum is also building at the institutional level. With Bolivia reversing its crypto ban, and integrating stablecoins into the financial system banks are now beginning to offer crypto-based products. Banco Bisa became the first bank in the country to launch a USDT custody product.

As more individuals across Latam hold stablecoins, they will increasingly look for ways to deploy those assets productively. This creates a growing opportunity for Zivoe and others offering tokenized real-world asset products.

👀 What’s Next

As we move into the final weeks of the year, we are focused on finishing strong and setting up a clear path for early 2026. Our next newsletter later this month will share a deeper look at our priorities for the year ahead, including how we plan to scale, enhance transparency, and continue expanding access to tokenized private credit. Stay tuned.

In the meantime, if you’d like to learn more about gaining exposure to one of the fastest-growing segments in crypto with Zivoe, reach out at [email protected] or message @thorabbasi on Telegram.

Reply